Andy Marken’s Content Insider #214 - Mobile Wallet

“ I told you- good day I'm okay, bad day I'm okay. Stop bugging me on my feelings. They're irrelevant.” – Lewis Zabel, “Wall Street: Money Never Sleeps,” 20th Century Fox, 2010

Joe Corzine, former head of MF Global, “misplaced” $1.2B of investors’ money but was certain it would show up.

The EU stress tested a bunch of banks (to see if they could withstand a financial fiscal shock attack), a lot failed.

Talk about stress testing U.S. banks is avoided because…

Banks, credit card companies and digital site folks (Google, PayPal, Apple, etc) want to make life easier for you – they want to eliminate the need to handle all that dirty, filthy money and hauling out your plastic every time you want to buy something.

Face it, money - dollars, rubles, pounds, francs, yen, Yuan, etc. – doesn’t really exist. It’s just a bunch of ones and zeros flying from cloud to cloud.

To save yourself from carrying all that junk, you can do it all with your feature/smartphone.

Your phone is always with you anyway for playing your music, showing you your videos, sending you the latest news, giving you your exercise plan, keeping your appointments, showing you how to get from home to office.

So, it’s the logical place for your money.

Nirvana awaits … a truly cashless world.

And as Gordon Gekko said, “It's not about the money. It's about the game between people.”

Despite the rosy projections (wishes) financial institutions, service providers, paid analysts are making, web measurement firm Compete found that only seven percent of banking consumers said they would be likely to pay bills with their devices.

Only five percent said they would use the device for making deposits.

Most of the folks who carried credit/debit cards said it was unlikely that they would begin managing their cards or using their mobile device for point-of-sale purchases.

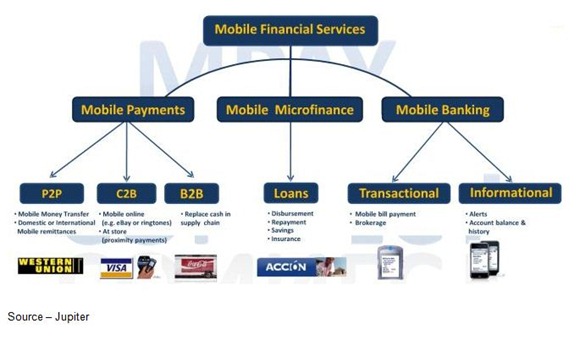

Phone Near You – Financial mobile apps and new phones with NFC (Near Field Communications) chips are being touted as the way for people to shed that ugly bulge in their pocket/purse by letting you do all your financial transactions with new phones. Many (including the financial industry) are making it look like the modern way to handle your money, but it still requires a lot of new technology and consumer education.

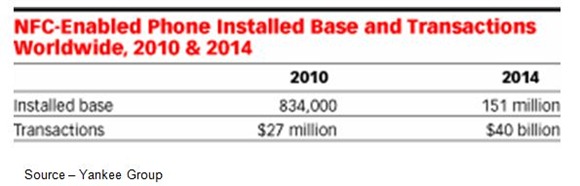

In 2010, only a measly 800M plus had NFC (near field communications) phones; but by 2014, there will be a whopping 151M.

Yeah, but the phone people say there are already more than 6B devices in use by the more than 7B people on the planet.

People are using their mobile devices for financial transactions:

-

U.S. consumers racked up nearly $40B in purchases using their mobile device

-

Tap-and-go phone services for air, rail, bus travel and entertainment events is still limited in the Americas, Europe

-

Japan has embraced the concept where more than 47 million people use the devices

-

Chinese industry analysts project that by 2013, there will be more than 169 million tap-and-go payment users (they have a couple of billion citizens)

Heavy Load – Instead of carrying all of those other mobile devices with you like your ultrabook and tablet, make it easy on yourself by letting your smartphone be your all-purpose device for communications, entertainment, financial management, and living.

The potential for mobile payments is huge. And, it would dramatically reduce the cost to financial institutions to “manage” your money.

Credit Living

Globally, consumers make trillions of dollars in credit and debit card transactions each year. Migrating just a small percentage of that spending to mobile-based transactions would be a lucrative opportunity for the companies that facilitate it.

It’s so cool the institutions that helped the world in the last few years have it all figured out how to do it for us.

As Gordon Gekko said, “The mother of all evil is speculation.”

Open 24-Hours a Day – Financial institutions and technology developers already have a master plan for turning money digital. All it requires to succeed will be new government regulations, new technology, new implementation, and new users.

Twenty countries are expected to launch NFC services in the next 18 months. All they have to do is change users behavior. You know, convince folks how much better it will be to pay with mobile phones instead of cash and cards.

Changing a person’s habits is tough; but the financial industry’s record so far has been spotty at best, at least in the U.S.:

-

400,000 ATM users

-

600M credit cards

-

520M debit cards

-

Pay with fingerprint failed because of privacy concerns

-

Video tellers came, went real fast

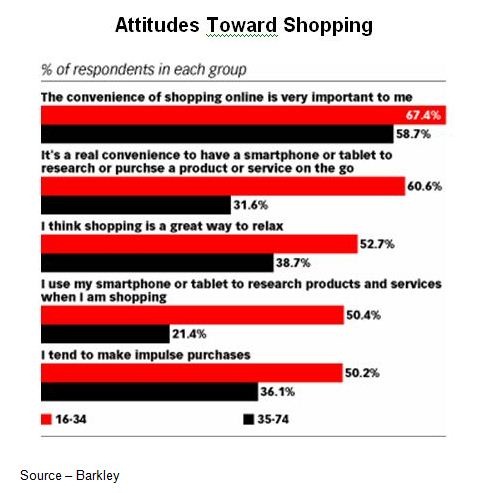

Don’t get us wrong; we love eCommerce and being able to shop for we want when we have the idea and no matter what we’re wearing.

We were one of the mob that makes Cyber Mondays huge year-round with our computer, tablet and yes smartphone.

Convenience – Mobile devices – primarily tablets, smartphones – became the weapon of choice for consumers this past holiday season to locate products and services they wanted at the best possible price. A growing number of people are also increasingly comfortable in purchasing the items over the air.

Heck, we even liked Amazon’s Price Check...and we’re not afraid to use it in the store.

mCommerce Growing

mCommerce in the U.S. was worth about $240B this last year; and as more and more people (kids) use their smartphone for everything, it could be over $1T by 2015.

However, as Gordon Gekko pointed out, “Idealism kills every deal.”

Strip away the wild hype and its penetration is just O.K.

If you’re a $5 Starbucks/iPhoner, of course you want to use their tap-n-go app. But if you’re an Android phone user, how “hot” is it to use your phone at Dunkin Donuts or Dairy Queen?

Breakfast On the Go – A growing number of retailers are testing mobile payment programs despite people’s concern about losing their phone, or worse yet, losing their personal/private data. While the smartphone infrastructure has considerable security in place, outside apps which can tap into the personal data are a sticky issue.

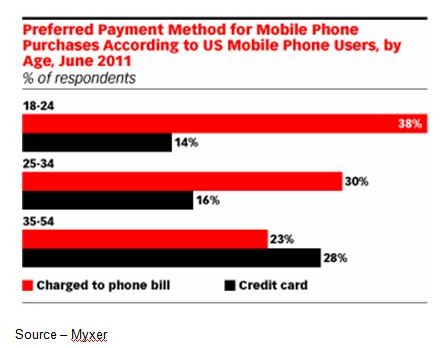

Younger kids like the idea of the all-in-one smartphone.

Around the globe, people make trillions of dollars in credit, debit card transactions each year.

All the financial industry has to do is convince a small percentage of these folks – those raised digitally – that using mobile-based transactions is the natural order of things and they can save/make billions!

Mobile Payments – Consumers in Japan are already very comfortable using their smartphones to pay on-the-go pay for a growing array of products and services. Younger individuals who have grown up with mobile devices see no issue using the phone for charges compared to dragging out, swiping a credit card.

Everyone wants in on the action.

But as Gekko noted, “It's easy to get in - it's hard to get out.”

The carriers have launched their solution called Isis. They’ve opened it up all of the financial service providers.

All On Board

Banks, phone companies and other firms are pouring huge sums of money into mobile-payment technology.

But after an initial wave of excitement, we’re like Gartner and have our doubts/questions on whether it will be of interest to enough consumers to anything more than a digital curiosity. After all, the financial industry has spent billions for years to give us new (better) ways to pay for stuff.

It took 50 years for plastic to triumph in the U.S.; and even today, most transactions under $10 still use cash.

Then to are the estimates it will cost $15 billion to deploy the technology that will make mobile payments ubiquitous.

Throwing a damp blanket on NFC, Gartner points out all those folks are trying to persuade us to use a technology we don’t really need at this stage. And at this stage, it isn’t that good.

None of the folks like to address the security issue which is still “a work in progress.”

The Next Big Thing – Cybercrime – and counter agent security sales – has grown rapidly over the past five years as hackers have become increasingly good at tapping into computers and enterprise networks. While still relatively safe, security experts see the smartphone as the next big target for thieves as people place more and more of their personal, private information on the go-anywhere, all-the-time mobile device.

Google stores a significant amount of data, unencrypted, on the device itself, providing fairly easy access to your personal information.

New Cybercrime Opportunity

Security folks work tirelessly to protect computer networks and PCs. And they have a long history of being one step behind the bad guys.

Gekko commented, “Stop telling lies about me and I'll stop telling the truth about you.”

Today, we have more than one million apps and five billion user devices worldwide.

Lookout Mobile Security estimated that more than $1M was stolen from Android users last year. The firm is pretty sure that the criminal element will be even more profitable over the next few years as they turn their attention to mobile devices which are remarkably unprotected by individuals even though security solutions are available.

The bad guys/gals are already busy with automated repackaging that repackages malware automatically. They’re busy developing new, better browser attacks and maladvertising – phony ads and coupons.

In addition to the security concerns Compete found that just seven percent of banking consumers said they might use their phone or tablet to make bill payments.

Only five percent would use them to make deposits. The same number said they would use the devices to manage their debit/credit card balance.

Beyond Wiretaps

We’ve already read about hackers tapping into folk’s phones like News Corp’s activities.

Mobile security folks follow the same guidelines they do for all of their security work, “if you wait for it to become a problem, it’s too late.”

They try to give you a little assurance by pointing out that you’re more likely to just leave it in a cab than you are going to be attacked by a hacker.

Still, no one has yet to tell us what fees are involved, or how much protection we have in the event of accidental or fraudulent charges.

We know … they’ll get back to you on that.

Right now, they’re trying to figure out where their electronic funds are located!

Misplaced – Financial institutions may misplace millions of dollars each day as they send transactions over the Internet, but they see a great opportunity to reduce their costs by encouraging people to use their mobile devices for more and more of their transactions.

As Jacob Moore said, “If it weren't for people who took risks, where would we be in this world?”

Andy Marken is President of Marken Communications

Follow @johnobeto